-

What happens if my AutoPay payment fails?

When an AutoPay payment fails due to insufficient funds, and you don’t schedule a separate manual payment, our system will automatically initiate a second automated attempt to collect your payment. If this second attempt fails and you still don’t schedule a separate manual payment, our system will automatically initiate a third attempt. If the third attempt fails, there will be no more automated attempts to collect your payment.

Here's the breakdown:

- 1st AutoPay attempt occurs on your due date.

- 2nd AutoPay attempt occurs 7 calendar days after the due date

- 3rd AutoPay attempt occurs 13 calendar days after the due date

If you know that any AutoPay payment attempts will fail to process, please contact us as soon as you can to discuss your options.

-

What is PROSPER/WEBBANK on my Credit Report?

- What is PROSPER/WEBBANK on my Credit Report?

- If you see a PROSPER/WEBBANK line on your credit report, it stands for Prosper Marketplace/WebBank. This means that you have recently applied for a personal loan through Prosper Marketplace that is originated by WebBank.

- What is PROSPER/WEBBANK on my Credit Report?

-

What happens if I’ve been affected by a natural disaster?

Natural disasters, such as hurricanes, floods, or wildfires, can upend our lives. Prosper is committed to supporting our customers affected by these events.

We will need to learn as much as we can about the situation to determine which relief options, if any, are available. Generally, we base our relief zones on FEMA declared disaster areas.

If you’ve been affected by a recent natural disaster and need help with your monthly payment, please know it can take us a few days to review whether we can provide relief. To let us know you need assistance, we recommend you email your request directly to the appropriate address below:

- Personal Loans

support@prosper.com - Prosper® Card

support@prospercards.com - Home Equity

Please contact the servicer of your home equity product directly to see if they offer any relief options:

Spring EQ

888-978-9978

Servicing@SpringEQ.com

If you prefer to speak with us over the phone, please don’t hesitate to give us a call.

- Personal Loans

-

I believe the FICO® Score displayed on my online account is wrong. How do I dispute this?

FICO® Scores are calculated from the credit data in your credit report. The FICO® Score provided on your online account is based on information from your TransUnion credit report and comes directly from TransUnion. To dispute information in your credit report, please contact the credit bureau directly:

TransUnion

1-800-916-8800

www.transunion.com/credit-disputes

TransUnion LLC Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016 -

How do I opt out of viewing my FICO® Score?

To opt out of viewing your FICO® Score Display from your online account, log in to your online account and open your FICO® Score Display. You can opt out using the link near the bottom of the page. Remember that viewing your FICO® Score does not impact your credit rating. You can always [opt back in].

-

Why don’t I see my FICO® Score through my online account?

That depends – there could be a couple of reasons why you don’t see your FICO® Score Display in your online account.

- You may need to [opt in] to view your FICO® Score

- Your FICO® Score is only available on your account after your loan completes its first billing cycle

- You must have an active loan through Prosper to view your FICO® score

- You must be the primary borrower on your joint loan if you share one with a co-borrower. If you have a joint loan but do not see the ability to opt in to view your FICO® Score, then you are not the primary borrower.

- If your account has charged off or you have filed bankruptcy, your account has been opted-out of FICO® Score Display.

-

What will I see if I opt into using the FICO® Score Display?

While you have an active personal loan through Prosper and your account remains current, you will continue to access your monthly refreshed FICO® Score, along with:

-

- Factors impacting your score

- A history trendline of your score since you last opted-in to viewing your FICO® Score Display

-

-

How can I opt in to view my FICO® Score?

Only personal loan borrowers with active loans through Prosper [can view] their FICO© Score through their online account.

To opt in to your FICO® Score Display, log in to your Prosper account and select the FICO© Score option from the dropdown menu on the top right of the page.

You can [opt out] of viewing your FICO® Score Display at any time.

-

Can I use my pre-approved confirmation number when applying for a loan using the Personal Loan App?

At this time, no – we’re not set up for that yet! If you want to apply using your pre-approved 8-digit confirmation number found on the personal loan invitation you received, head to www.prosper.com.

-

Can I change my loan’s due date using the Personal Loan App?

At this time, no – we’re not set up for that yet! However, this doesn’t mean that you can’t change your due date from the web.

For more guidance on changing your due date, click here.

-

How do I link my bank account using the Personal Loan App?

At this time, you can only add a bank account in the Personal Loan app when accepting a new loan offer. If you’d like to add a new bank account to your Prosper account, please log in at www.prosper.com.

-

How do I update my personal information using the Personal Loan App?

After you sign into your account in the Personal Loan App, select Menu at the bottom of the screen.

Under General, select Account Info to access and edit your personal information.

-

How do I download a payoff quote for my loan using the Personal Loan App?

After you sign into your account in the Personal Loan App, select See Details to bring up the details of your loan.

Within “See Details,” select Download Payoff Quote.

-

I'm having issues signing into Prosper's app. What's going on?

We’re sorry you’re having issues signing into our app.

There could be a couple of reasons you’re running into problems:

- You may need to reset your password

- We have multiple apps - make sure you’re attempting to sign into the one that’s associated with your product (Personal Loan, Investor, Credit Card)

- At this time, co-borrowers can’t sign into the Personal Loan app – we’re not set up for that yet!

If you’re still having trouble accessing one of our apps, please contact us for assistance.

-

Does Prosper have an app?

Yes! We actually have multiple apps:

Personal Loan

Use the Prosper: Personal Loans app to apply for a personal loan in minutes with no impact to your credit score. Or, if you’re an existing user, then you can use the app to easily access your account and do any of the following:

- Schedule payments, enroll in AutoPay, and review payment history with ease

- Download payoff quotes directly to your mobile device

- Update personal information quickly and conveniently

You can find the Prosper: Personal Loans app on iOS and Google Play.

Investors

Now you can manage your Prosper investment portfolio on the go, using the Prosper: Invest app.

- Set up, review, and adjust your target portfolio allocations using our Auto Invest tool

- Invest manually by browsing and selecting from individual loan listings

- Add cash to your Prosper investment account in one-time, weekly or monthly increments

- View details on each Note you’ve invested in, at a glance

- View your total gain/loss to date

- See how your investments have impacted the lives of borrowers across the country

- Keep tabs on how your portfolio is performing

Note that you must have an active Prosper investor account to use this app. You can setup your Prosper investor account on the web at www.prosper.com/invest.

You can find the Prosper: Invest app on iOS and Google Play.

Prosper Card

The Prosper Card app makes it easy for cardholders to track and manage their payments among other features that include:

- Access to a digital line of credit before receiving the physical card

- A simple way to review payments and easy-to-see available balance

- A streamlined way to review (and dispute) transactions, all within the app

You must have an active Prosper Card account to use this app.

You can find the Prosper® Card app on iOS and Google Play.

-

Frequently Asked Questions about FICO® Scores

What are FICO® Scores?

FICO® Scores are the most widely used credit scores. Each FICO® Score is a three-digit number calculated from the data on your credit reports at the three major consumer reporting agencies—Experian, TransUnion, and Equifax. Your FICO® Scores predict how likely you are to pay back a credit obligation as agreed. Lenders use FICO® Scores to help them quickly, consistently, and objectively evaluate potential borrowers’ credit risk.Why are you providing FICO® Scores?

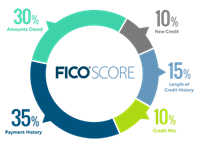

Nearly all lenders in the U.S. use FICO® Scores, as the industry standard for determining credit worthiness. Reviewing your FICO® Scores can help you learn how lenders view your credit risk and allow you to better understand your financial health.What goes into FICO® Scores?

FICO® Scores are calculated from the credit data in your credit report. This data is grouped into five categories; the chart below shows the relative importance of each category.1. 35% – Payment history. Whether you've paid past credit accounts on time

2. 30% – Amounts owed. The amount of credit and loans you are using

3. 15% – Length of credit history. How long you've had credit

4. 10% – New credit. Frequency of credit inquires and new account openings

5. 10% – Credit mix. The mix of your credit, retail accounts, installment loans, finance company accounts and mortgage loans

What are score factors?

Score factors are delivered with a consumer’s FICO® Score, these are the top areas that affected that consumer’s FICO® Scores. The order in which the score factors are listed is important. The first factor indicates the area that most affected the score, and the second factor is the next most significant influence. Addressing these factors can benefit the score.Why is my FICO® Score different than other scores I’ve seen?

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data from a consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores.Why do FICO® Scores fluctuate/change?

There are many reasons why a score may change. FICO® Scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a consumer reporting agency at that time. So, as the information in your credit file at that CRA changes, FICO® Scores can also change. Review your key score factors, which explain what factors from your credit report most affected a score. Comparing key score factors from the two different time periods can help identify causes for a change in a FICO® Score. Keep in mind that certain events such as late payments or bankruptcy can lower FICO® Scores quickly.Will receiving my FICO® Score impact my credit?

No. The FICO® Score we provide to you will not impact your credit.How do I check my credit report for free?

You may get a free copy of your credit report from each of the three major consumer reporting agencies annually. To request a copy of your credit report, please visit: www.annualcreditreport.com. Please note that your free credit report will not include your FICO® Score. Because your FICO® Score is based on the information in your credit report, it is important to make sure that the credit report information is accurate.How often will I receive my FICO® Score?

Program participants will receive their FICO® Score 8 updated on a monthly basis, when available.Why is my FICO® Score not available?

· You are a new account holder and your FICO® Score is not yet available

· Your credit history is too new

· You are not the primary account holder

Useful Links

Frequently Asked Questions about FICO® Scores

FICO® Score Educational Videos

o Understanding Your Credit Report

o What goes into FICO® Scores?

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

FICO® Score and associated educational content are provided solely for your own non-commercial personal educational review, use, and benefit.

Prosper and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Prosper and Fair Isaac do not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.

2021 Fair Isaac Corporation. All rights reserved.

-

I uploaded my co-borrower's documents through my account. Is that okay?

Yes, that’s okay! We’ll re-assign those documents to your co-borrower’s account and it won’t affect your application’s review process.

-

Am I supposed to make the payments on the loan or is my co-borrower?

Both borrowers can make payments on your joint loan at any time. As long as either one of you makes your monthly payment on or before your due date, you’ll be in good standing!

If you don’t want to worry about scheduling payments, you can always turn on AutoPay. AutoPay connects to your bank account to make monthly payments for you so you don’t have to worry. Just sign in to your Prosper account and select Turn on AutoPay to enroll!

-

I’m listed as a co-borrower, but I didn’t accept this loan!

We’re very sorry to hear this. We take identity theft very seriously and want to assure you we thoroughly investigate each claim. Please give our Customer Service Team a call to formally file an identity theft claim as soon as possible.

-

Are there fees to enroll in AutoPay?

No, AutoPay is free!

-

What happens to AutoPay if I make a separate payment?

If you’re enrolled in AutoPay but you want to make a separate payment, here are a few things to consider:

- If you make a full monthly payment before your due date, AutoPay won’t process for that billing cycle.

- If you make a smaller payment that isn’t enough to pay the full amount due for the month, AutoPay will still process the full monthly amount due on your account. Unless you make separate payments to satisfy the full monthly bill before your due date, AutoPay will continue to process the full monthly payment amount on your due date.

- Interest accrues daily. If you’re looking to make a one-time, principal-only payment on your loan while enrolled in AutoPay, a simple way to do that would be to schedule the additional payment on the same day as your AutoPay payment.

- If you make a full monthly payment before your due date, AutoPay won’t process for that billing cycle.

-

Can I pay more than just my monthly minimum payment when using AutoPay?

Yes, if you want to pay more than just your minimum monthly payment while using AutoPay, you can! Give us a call and we can add as much as you’d like on top of your monthly automatic payments.

-

Can I change my due date even if I'm past due?

No, your loan must be current in order to change the due date. If you’d like to talk about options for getting your account current, please give us a call.

-

Is there a fee to change my due date?

No, there is no fee to change your due date. That said, interest accrues daily and changing your due date may result in the accumulation of additional interest. You can pay this interest when you first change your due date or you can let it roll until the end of your loan term, at which time the full remaining balance on your account would be due.

-

How many times can I change my due date?

You should be able change your due date once every 365 days—provided your account remains in good standing (and therefore eligible).

-

I accidentally made my payment twice! What should I do?

If you unintentionally scheduled two payments this month, give us a call as soon as you can. We’ll find out if we’re able to cancel the extra payment before it processes. If we can’t, we’ll discuss your options.

-

I’m a co-borrower, how do I make a payment?

Whether you’re an individual borrower or a co-borrower, you can easily schedule a payment by signing in to your online Prosper account.

-

What if I know my payment will be denied by the bank?

If you know your payment will be denied by your bank, please give us a call as soon as you can.

-

I didn’t have to send in documents for my last loan. Why do I need to send them in now?

We’re glad to hear that you’re interested in another loan through Prosper! Each loan offer we provide is based on your credit profile and financial situation at the time of your application. Even if your personal or employment information hasn’t changed since your last loan, we may still need to request documents because each loan offer is unique.

-

Why do I need to send in documents to get my loan? Won’t this make the process take longer?

We ask for documents to verify the information you included on your application, but don’t worry! Our Verification Specialists can help with any questions you might have about the required documents. A good way to keep the process moving forward is to follow our upload tips to avoid any inconvenient technical problems.