-

How are 2 and 4-year term loans assigned a Prosper Rating?

The Prosper Rating is a proprietary credit rating that we assign to each listing. The Prosper Rating is a letter that indicates the level of risk associated with a listing and corresponds to an estimated average annualized loss rate range for the listing. There are currently seven Prosper Ratings, represented by seven letter scores from A-HR, but this, as well as the loss ranges associated with each, may change over time as the marketplace dictates. The estimated average annualized loss rate for each listing is based on the following scores: a consumer reporting agency score and one or more custom Prosper scores calculated using the historical performance of previous Borrower Loans with similar characteristics (a “Prosper Score”), as may be supplemented by additional proprietary scoring models. We use these scores to determine an estimated average annualized loss rate for each listing, which correlates to a Prosper Rating. This rating system allows for consistency when assigning ratings to listings.

To assign the Prosper Ratings to the 2 and 4-year term loans we began offering to borrowers, we utilized personal loan industry data tracking performance for loans with the same terms. This industry data, along with the historical performance of our 3 and 5-year term loans, support our estimates of the average annualized loss rate and ultimately the designation of a Prosper Rating for these new loans.

The Prosper Rating assigned to a loan listing may not accurately reflect the risks of investing in the Notes and is not a recommendation by us to purchase a Note. No assurances can be provided that the actual loss rates for the Notes will come within the estimated average annualized loss rates indicated by the Prosper Rating. The interest rate on the Notes might not adequately compensate Note investors for these additional risks. Please review a copy of our latest Prospectus, including the “Risk Factors” section, for more information.

-

How do I close my investment account?

We’re sorry to hear that you want to close your investment account!

To close your account, you’ll need to give us a call and our team will walk you through the account closure process.

Please note that if you close your investment account, you will no longer be able to collect any additional cash generated from your outstanding active Notes or potential recoveries from past charged-off Notes. As a result, you will need to either withdraw any remaining cash balance or forfeit the remaining cash balance, any active Notes, and potential recoveries on charged-off Notes in order to close your account.

-

What does the "account value" of my investment portfolio represent?

The total account value includes:

- cash available in your investment account

- any pending Note investments

- outstanding Note balances

-

How liquid are my investments through Prosper?

Personal Loans offered through Prosper are 2-, 3-, 4-, or 5-year terms - meaning borrowers make fixed monthly payments throughout the duration of their loan’s term. Each payment is comprised of principal, interest, and any applicable fees. Investors receive a portion of those payments that are proportional to their pro rata share of the loan. These funds are deposited directly into investors’ Prosper Accounts as uninvested available cash.

Any uninvested available cash in your account is FDIC-insured and can be withdrawn whenever you wish, but your investment (principal and interest) is repaid to you over the course of the underlying loan term.

-

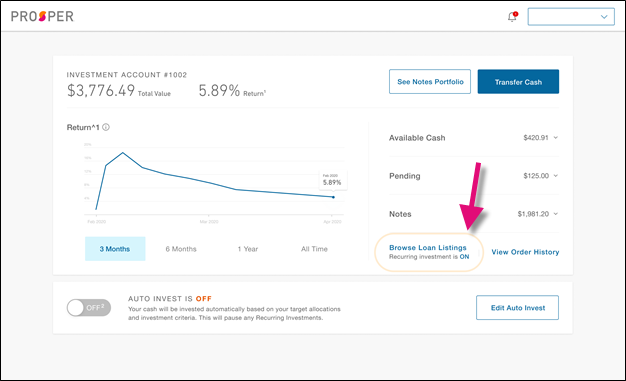

How do I deactivate my recurring investment?

Recurring Investments are different than Auto-Invest. If you want to pause or turn off Auto-Invest, visit this article instead.

To deactivate your recurring investment:

- Sign in to your online Prosper account.

- View Your Investments page.

- Near the bottom of the page, next to Notes and View Order History, select Browse Loan Listings

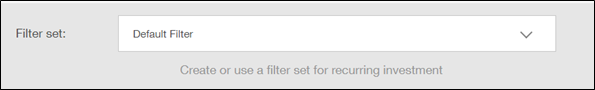

- Select Filter Set and filter the listings to your existing recurring order preference.

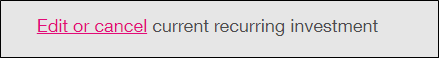

- Select Edit or Cancel to select the recurring order you’d like to edit or cancel.

- Select Continue

- Confirm the cancellation by selecting Cancel existing recurring order

Please know that if you decide to turn on Auto Invest, this will pause your recurring investments.

If you need additional help, feel free to contact us.

- Sign in to your online Prosper account.

-

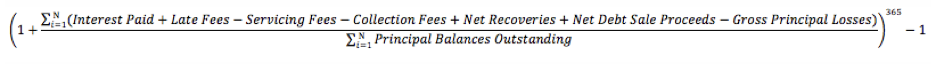

How is my Investment Return Calculated?

Investor Return is an annualized measure of the rate of return on the principal invested over the life of an investment. Returns are based on actual borrower loan payments (other than principal) received, net of fees and losses (including from charged-off loans.

Your Return is calculated using a formula where (A) the numerator is equal to the sum of all the interest received on active Notes, plus all late fees received on active Notes, minus all servicing fees paid, minus all collection fees paid, plus all net recoveries received on charged-off or defaulted loans, plus all net debt sale proceeds received on sold loans, plus all net sale proceeds received on Notes sold on Folio, minus gross principal losses, plus any investor promotions credited to your account; and (B) the denominator is equal to the sum of the amount of active principal balance outstanding at the end of each month since account opening. The results are then multiplied by 12 to get an annualized return. This gives us the “Return” for your Prosper Notes.

For purposes of this calculation, “active” means a Note whose corresponding borrower loan is current in payments or delinquent less than 120 days; Notes with corresponding borrower loans that have paid off, charged-off or are in default are not considered active. For Returns calculated by Prosper Rating, references to "Notes" and "loans" means Notes and loans with the specified Prosper Rating.

The Return calculation: (i) is updated monthly; (ii) only includes Notes whose corresponding borrower loan originated on or after July 1, 2009; (iii) only reflects the performance activity that occurred during the time period the Notes were held in this specific Prosper investment account; and (iv) excludes the impact of servicing related corrective non-cash adjustments that may modify the outstanding balance or status of a borrower loan.

The actual return on any individual Note depends on the prepayment and delinquency pattern of the borrower loan underlying each Note, which is highly uncertain. Historical performance is no guarantee of future results.

-

Can I open a joint investment account with Prosper?

No, only individual investment accounts are possible at this time.

-

When is a delinquent loan sold to a debt buyer?

Before we attempt to sell a delinquent loan, we attempt every commercially reasonable effort to collect on the debt before we consider selling it to a debt buyer. These methods include referring loans to a collection agency or initiating legal action against delinquent borrowers.

Once we’ve exhausted all collection options, we consider selling the delinquent loan. However, it’s possible some delinquent loans may not be purchased by or sold to debt buyers.

-

Frequently Asked Questions about Historical Returns

How do you Calculate Historical Returns?

Historical Returns are based on actual payments (other than principal) received by the investor net of fees and losses (including from charged-off loans). To be included in the Historical Return calculation, the loan must have originated (a) on or after July 1, 2009, and (b) at least 12 months prior to the calculation date.1

We calculate the Historical Return for loans originated through Prosper as follows. First, loans are separated into distinct “Groups” based on the specific month and year in which they were originated and their Prosper Rating or mix of Prosper Ratings (as applicable) at origination.

For each Group, we calculate: (a) the sum of the Interest Paid, plus Late Fees, minus Servicing Fees, minus Collection Fees, in each case on active loans2, plus Net Recoveries on charged-off or defaulted loans, plus Net Debt Sale Proceeds on sold loans, minus Gross Principal Losses; divided by (b) the sum of the Principal Balances Outstanding on active loans2 at the end of each day since origination.1 We then annualize the result to get the “Historical Return” for the Group.*

The Historical Return for any Group can be expressed with the following formula, where “i” is time in daily increments starting from the first day of the applicable origination month (i=1) until the last day of the most recently completed month (i=N).

Historical Return for the Platform*

Once the above calculation is performed for every Group, we compute the cumulative-outstanding-principal-dollar-weighted average of their Historical Returns. This gives us the weighted average Historical Return for loans originated through Prosper. 1

Historical Return Range for Range for Single or Multiple Prosper Ratings*

Once the above calculation is performed for every Group, we compute the 10th and 90th cumulative-outstanding-principal-dollar-weighted percentiles of the Historical Returns of the Groups within each Prosper Rating or mix of Prosper Ratings (as applicable) to get the Historical Return Range of the relevant Prosper Rating or mix of Prosper Ratings. 1

1 The Historical Return calculation excludes the impact of servicing related corrective non-cash adjustments that may modify the outstanding balance or status of a borrower loan.

2 For purposes of the Historical Returns calculation, “active” means loans that are current in payments or delinquent less than 120 days; loans that have paid off, charged-off or are in default are not considered active.

* Historical Return data presented on the website is updated monthly. Historical performance is no guarantee of future results. This information is not intended to be investment advice or a guarantee about the performance of any Note. The actual return on any Note depends on the prepayment and delinquency pattern of the loan underlying each Note, which is highly uncertain. Individual results may vary.

How does this change what I see on the Prosper website and in my account?

As of 5 pm (PT) on August 8, 2018, estimated return information is no longer shown on prosper.com. Instead, historical ranges for each Prosper loan rating are shown. In addition, all loan listings show this new historical return range information.

How can I select the returns I want to search for?

Simply select the Prosper rating with historical return information that corresponds with the return that comes the closest to what you are looking for.

I have a recurring investment filter set up to automatically invest in loans based on estimated returns and estimated losses. Do I need to do anything? Will my filter continue to invest in loans?

If you have a recurring investment order that uses either estimated return or estimated loss filters, you will need to remove the filters and update your order. These filters will be disabled on the evening of August 1, 2018, and no new Recurring Invest orders will be processed which use these filters.

To ensure your recurring investment order continues without interruption, please remove the estimated return or estimated loss filters from your order before August 1, 2018.

To remove filters and update your recurring investment order:

- Sign in to your Prosper investment account.

- From your investments page, click Browse Listings.

- Select your active recurring investment from your Filter set

- Delete filters by clicking the X next to each filter you want to delete.

- Click Update Settings, and you’re done.

If you have any saved filter sets with estimated return or estimated loss filters selected, please remember to update them, as well.

I use the Prosper Investor APIs. Has anything changed in the APIs?

Yes, the estimated_return, estimated_loss_rate, and effective_yield elements will be removed from all listings that are created after August 8, 2018.

The listings API and the orders API will be modified to support the historical return data, which may impact your use of these APIs. To learn about the specific updates being made to Investor APIs, visit the Prosper for Developers Release Notes page.

-

Can I still place manual orders if I use Auto Invest?

Yes. As an Auto Invest user, you may browse loan listings and place manual orders yourself at any time. However, doing so may result in a portfolio of Notes that diverges from your Auto Invest investment criteria and allocation targets.

-

My target allocation is less than my current allocation. Will this setting work?

You can set your target allocation to be less than the current allocation. However, Auto Invest will NOT sell Notes to re-balance your portfolio; it only places orders for listings according to your investment criteria.

Example. Let’s say your current allocation is 10% AAs, 5% A, 10% B and 75% Cash; and you set a target of 0%AA, 0%A, 0%B, 50%C, 50%D and 0% Cash. In this case, Auto Invest will:

- NOT sell the AAs, As and B notes in your current portfolio.

- Place orders for C and D notes only, but will be unable to reach your target allocation while you continue to hold AA, A and B notes.

-

How long does it take for Auto Invest to invest my cash?

The cash in your account may be deployed immediately or over a long period of time. The frequency of orders is based on the cash balance of your account, availability of listings matching your investment criteria and demand from other investors. Auto Invest prioritizes accounts with a higher percentage of cash and places orders for these accounts first. Account size and customization are NOT used for prioritization.

-

What are the costs/fees associated with using Auto Invest?

There are no additional costs or fees for using Auto Invest. Standard loan servicing and collections fees apply to all Notes held in your Prosper account.

-

Is there an account minimum for Auto Invest?

No, there is no account minimum for Auto Invest.

-

Can I cancel the orders placed by Auto Invest?

No, you cannot cancel or withdraw an order once it is placed by Auto Invest.

-

What is cash reserve? Why do I need to set it?

Setting a cash reserve is completely optional. Investors can choose to set aside a percentage of their portfolio in cash, as a cash reserve. By doing so, Auto Invest will only use funds in excess of your cash reserve to place orders, and will not place orders until this cash reserve level is met. You can change your cash reserve at any time by adjusting the percentage of cash in your target allocation.

-

What is Auto Invest?

Auto Invest is an investment tool that automatically invests available funds based on your selected parameters.

- There are no fees and no minimum account requirements to use Auto Invest.

- Individual investors can set a target allocation and other investment criteria. In turn, Auto Invest will places orders for matching Notes on their behalf. Please know that Auto Invest does not sell your Notes to re-balance your portfolio; it only places orders for new listings according to your investment criteria.

- The cash in your account may be invested immediately or over a long period of time, depending on your investment criteria. The frequency of Note orders is based on the cash balance of your account, availability of listings matching your investment criteria, and demand from other investors.

- Auto Invest prioritizes accounts with a higher percentage of cash and places orders for these accounts first (in other words, Auto Invest will give priority to accounts that have not yet heavily invested in Notes). Account size and customization do not determine prioritization.

Getting Started with Auto Invest

To get started with Auto Invest, you only need to define your investment criteria and save these settings in your Prosper Account. The basic investment criteria for Auto Invest includes (1) a target loan allocation and (2) the amount invested per Note.

When defining your investment criteria, you can:

- Select one of the preset target allocations, any of which can be customized by changing the percentage allocated to each loan rating

- Create a custom target allocation across Prosper loan ratings based on their risk tolerance

You can further customize their investment criteria by adding loan filters.

Once funds become available in your Prosper Account, Auto Invest will start investing. As the Notes held in the investor’s account generate principal and interest payments from borrowers, the account may accumulate a cash balance, which Auto Invest will reinvest automatically based on the investment criteria.

Cash Reserve

You can also add a “cash reserve” to your account, setting aside a percentage of your portfolio to be available as cash. By doing so, Auto Invest not place orders until this cash reserve level is met and will only use funds in excess of your cash reserve to place new orders. You can change the amount of your cash reserve at any time by adjusting the percentage of cash in your target allocation.

Pausing / Canceling Auto Invest

From your Prosper Account Dashboard, you can review, adjust, pause or re-start Auto Invest at any time. Please know that pausing or canceling Auto Invest will not cancel any pending orders that have been placed for your account.

Once Auto Invest stops placing orders, it will no longer invest your cash balance for you. The cash generated from principal and interest payments from borrowers may accumulate into your cash balance. You can withdraw [link to: How do I transfer funds to and from my investment account?] or reinvest your cash balance at any time.

Customizing Your Investment Criteria

You can customize your investment criteria by (1) editing your target allocation across the individual Prosper loan ratings and/or (2) applying additional criteria to the loans you would like to invest in.

- Keep in mind that using a restrictive investment criteria can limit the amount of Notes Auto Invest can purchase on your behalf. If that’s your preference, that’s okay! As always, we recommend consulting an investment advisor if you have questions about how to set your investment criteria.

You can also set your target allocation to be less than the current allocation.

- Example: Let’s say your current allocation is 10% AAs, 5% A, 10% B and 75% Cash; and you set a target of 0%AA, 0%A, 0%B, 50%C, 50%D and 0% Cash. In this case, Auto Invest will place orders for C and D notes only but will be unable to reach your target allocation while you continue to hold AA, A and B notes.

- There are no fees and no minimum account requirements to use Auto Invest.

-

How does Investing through Prosper work?

Prosper is an online peer-to-peer lending marketplace, where creditworthy borrowers can request a loan and investors can invest in “notes” (or portions) of each loan.

After a borrower accepts their loan offer, we may verify their application information. Upon borrower acceptance, investors have up to 14 days to commit funds to the loan through their Prosper account. Once a borrower passes any additional verification requirements and one or more investor(s) commit enough funds to the loan, it’s ready for origination.

Loans through Prosper are amortized, meaning borrowers make fixed monthly payments throughout the duration of their 2-, 3-, 4-, or 5-year term. Each payment is comprised of principal, interest, and any applicable fees. Investors receive a portion of those payments that are proportional to their pro rata share of the loan. These funds are deposited directly into investors’ Prosper Accounts. -

What are the minimum criteria to borrow on Prosper?

Any natural person at least 18 years of age who is a U.S. resident in a state where loans through our marketplace are available with a U.S. bank account and a Social Security number may apply to become a borrower. After a borrower submits a loan application, Prosper first obtains a credit report from TransUnion to evaluate whether the applicant meets the underwriting criteria Prosper has established in conjunction with WebBank.

WebBank originates loans to borrowers and then sells and assigns the promissory notes evidencing those loans to PFL. The underwriting criteria apply for all Borrower Loans originated through our marketplace and may not be changed without WebBank’s consent. For the Note Channel (i.e., loans funded through listings posted on our marketplace), all borrowers who request a loan are subject to certain minimum eligibility criteria in order to be approved.

Prosper also allows two borrowers to apply together as joint applicants for a co-borrower loan. Each borrower applicant is held jointly and severally liable for the obligations under the loan. In the case of co-borrower loans, the primary (or “specified”) borrower must satisfy the above credit criteria (except the debt-to-income ratio for joint loans is calculated using the combined debt-to-income ratio of the primary and secondary borrowers without duplication of combined debt). The secondary borrower must also satisfy certain additional credit criteria, including a minimum FICO score of at least 600, at least one open trade reported on the secondary borrower’s credit report, and no bankruptcy filings within the last 12 months.

In addition, a borrower may apply for up to two loans through Prosper outstanding at one time, provided that:

- First loan is current

- The aggregate outstanding principal balance of both loans does not exceed the then-current maximum allowable loan amount for loans (currently $50,000)

- The borrower has held his or her first Prosper loan for at least 6 months, and

- The borrower complies with the prior-borrower constraints below.

For co-borrower loans, the foregoing additional requirements will apply if either the primary or secondary borrower has a currently outstanding loan.

Further, for any borrower who has previously obtained a Borrower Loan through our marketplace, such borrower must also (1) have no prior charge-offs on Borrower Loans originated through our marketplace, and (2) have never been more than 15 days delinquent on any Borrower Loan obtained through our marketplace within 12 months of his or her application.

Underwriting requirements for Borrower Loans, including eligibility requirements for subsequent loans, are subject to change over time.

-

How does a borrower make payments on their loan?

Borrowers can make payments toward their loan in the following ways:

AutoPay

AutoPay is a service that automatically schedules and deducts a borrower’s monthly payment from their bank account on their due date. AutoPay is the preferred option for our borrowers because it offers convenience and reliability.

Pay Online

Borrowers can easily schedule ACH payments through their online Prosper account. They can manually schedule payments whenever they choose, knowing they need to satisfy their monthly bill by the due date. Some borrowers prefer manually making their payments through their online account each month.

Over the Phone

Our Customer Service team can take borrower payments over the phone. Borrowers have the same options with our Customer Service agents as they do when making their payments through their online account.

By Check

Borrowers can mail in a personal check, money order, or cashier’s check to make their payment. Most borrowers do not choose this method since mail delivery times can affect when a payment will arrive. However, this option is the most secure method for borrowers who need a third party (i.e. a family member or a debt consolidation company) to make a payment toward the loan on their behalf.

-

Where can I view past performance of loans through Prosper?

For past repayment history please visit our Prospectus.

-

How do I contact Prosper’s customer service? What are the hours of operation?

You can see all this information by checking out the Contact Us page of our main site.

-

Can I invest my Individual Retirement Account with Prosper?

Yes. Investing with Prosper is available for Individual Retirement Accounts (IRAs). If you’re contributing to your Traditional, Roth, or SEP IRA or plan to open an IRA or 401(k) rollover, we will work with you to open your Prosper IRA.

-

When are new loans added to the website?

New loan listings are added at 9AM and 3PM PT Monday through Friday and at 12PM PT on Saturdays and Sundays.

-

Can foreign investors participate on Prosper?

The Prosper platform is not available to investors residing outside the United States of America.

-

Where can I access the monthly statement for my investment account?

You can access your monthly statement by signing into your online account, navigating to your account’s History, and selecting Statements.

Monthly investor statements from previous calendar years will be automatically deleted from the site. Please download and save your statements offline for long-term storage.

-

What is the maximum amount of a loan I can purchase?

There is no maximum, but you must limit purchases to 10% of your net worth.

-

What happens after I make my investments?

After you place your investment, the loan request will remain active until the listing reaches full funding. If full funding is not reached by the 14th day but at least 70% of the listing is funded, the borrower still may receive a loan.

The borrower’s loan request will remain in a Pending Review status until Prosper completes the verification process and approves or cancels the application. Verification can take a maximum of 30-days for completion.

When a loan is approved, the borrower will receive their loan minus the loan origination fee (i.e. $10,000 loan with a $500 origination fee will result in a deposit of $9,500 to the borrower's account, but they're expected to pay the full $10,000 balance).

Investors will receive a borrower payment dependent Note, and interest begins accruing on the loan origination date. If the listing is cancelled prior to origination, or expires after the 30 days, the funds committed by investors will return to their Available Cash balance within five business days.

-

What is a "loan through Prosper" and who originates it?

Loans through Prosper are unsecured loans with a fixed interest rate. They’re paid back over a term of 2, 3, 4, or 5 years, unless the borrower chooses to prepay the loan (which can be done with no penalty to the borrower). They are originated by WebBank, an FDIC-insured, Utah-chartered industrial bank.

After origination, WebBank sells and assigns the loan to Prosper. We sell the loans or payment-dependent Notes to investors. For each loan, interest accrues against the principal balance daily. Investors are entitled to a portion of the borrower’s accrued interest for all periods after the loan is purchased from WebBank.

Loan Payments

Borrower payments are due once a month. Every time the borrower makes a payment, amounts that are payable to Note investors (such as principal, interest, and fee payments) are deducted from the borrower’s payment and deposited into each investor’s Prosper account. Learn more about how payments are allocated toward loans.

Joint Loans

Borrowers can apply for individual loans, where only one borrower is responsible for repaying the loan, or joint loans, where both co-borrowers are equally responsible for repaying the loan.

Note that we don’t allow “co-signers” on loans through Prosper - that’s a different type of relationship than the role of a co-borrower.

-

What types of investing accounts can I open with Prosper?

For retail investors eligible to invest, we offer general (taxable) investment accounts and individual retirement accounts.

General investment accounts may be held personally or in the name of a trust, estate, or business entity.

If interested in setting up an IRA with our qualified custodians, you may set up the following IRA account types:

- Traditional IRA

- Roth IRA

- SIMPLE IRA

- SEP IRA

- Rollover from an existing custodian