How do you Calculate Historical Returns?

Historical Returns are based on actual payments (other than principal) received by the investor net of fees and losses (including from charged-off loans). To be included in the Historical Return calculation, the loan must have originated (a) on or after July 1, 2009, and (b) at least 12 months prior to the calculation date.1

We calculate the Historical Return for loans originated through Prosper as follows. First, loans are separated into distinct “Groups” based on the specific month and year in which they were originated and their Prosper Rating or mix of Prosper Ratings (as applicable) at origination.

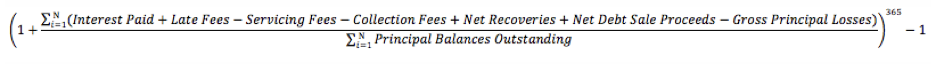

For each Group, we calculate: (a) the sum of the Interest Paid, plus Late Fees, minus Servicing Fees, minus Collection Fees, in each case on active loans2, plus Net Recoveries on charged-off or defaulted loans, plus Net Debt Sale Proceeds on sold loans, minus Gross Principal Losses; divided by (b) the sum of the Principal Balances Outstanding on active loans2 at the end of each day since origination.1 We then annualize the result to get the “Historical Return” for the Group.*

The Historical Return for any Group can be expressed with the following formula, where “i” is time in daily increments starting from the first day of the applicable origination month (i=1) until the last day of the most recently completed month (i=N).

Historical Return for the Platform*

Once the above calculation is performed for every Group, we compute the cumulative-outstanding-principal-dollar-weighted average of their Historical Returns. This gives us the weighted average Historical Return for loans originated through Prosper. 1

Historical Return Range for Range for Single or Multiple Prosper Ratings*

Once the above calculation is performed for every Group, we compute the 10th and 90th cumulative-outstanding-principal-dollar-weighted percentiles of the Historical Returns of the Groups within each Prosper Rating or mix of Prosper Ratings (as applicable) to get the Historical Return Range of the relevant Prosper Rating or mix of Prosper Ratings. 1

1 The Historical Return calculation excludes the impact of servicing related corrective non-cash adjustments that may modify the outstanding balance or status of a borrower loan.

2 For purposes of the Historical Returns calculation, “active” means loans that are current in payments or delinquent less than 120 days; loans that have paid off, charged-off or are in default are not considered active.

* Historical Return data presented on the website is updated monthly. Historical performance is no guarantee of future results. This information is not intended to be investment advice or a guarantee about the performance of any Note. The actual return on any Note depends on the prepayment and delinquency pattern of the loan underlying each Note, which is highly uncertain. Individual results may vary.

How does this change what I see on the Prosper website and in my account?

As of 5 pm (PT) on August 8, 2018, estimated return information is no longer shown on prosper.com. Instead, historical ranges for each Prosper loan rating are shown. In addition, all loan listings show this new historical return range information.

How can I select the returns I want to search for?

Simply select the Prosper rating with historical return information that corresponds with the return that comes the closest to what you are looking for.

I have a recurring investment filter set up to automatically invest in loans based on estimated returns and estimated losses. Do I need to do anything? Will my filter continue to invest in loans?

If you have a recurring investment order that uses either estimated return or estimated loss filters, you will need to remove the filters and update your order. These filters will be disabled on the evening of August 1, 2018, and no new Recurring Invest orders will be processed which use these filters.

To ensure your recurring investment order continues without interruption, please remove the estimated return or estimated loss filters from your order before August 1, 2018.

To remove filters and update your recurring investment order:

- Sign in to your Prosper investment account.

- From your investments page, click Browse Listings.

- Select your active recurring investment from your Filter set

- Delete filters by clicking the X next to each filter you want to delete.

- Click Update Settings, and you’re done.

If you have any saved filter sets with estimated return or estimated loss filters selected, please remember to update them, as well.

I use the Prosper Investor APIs. Has anything changed in the APIs?

Yes, the estimated_return, estimated_loss_rate, and effective_yield elements will be removed from all listings that are created after August 8, 2018.

The listings API and the orders API will be modified to support the historical return data, which may impact your use of these APIs. To learn about the specific updates being made to Investor APIs, visit the Prosper for Developers Release Notes page.